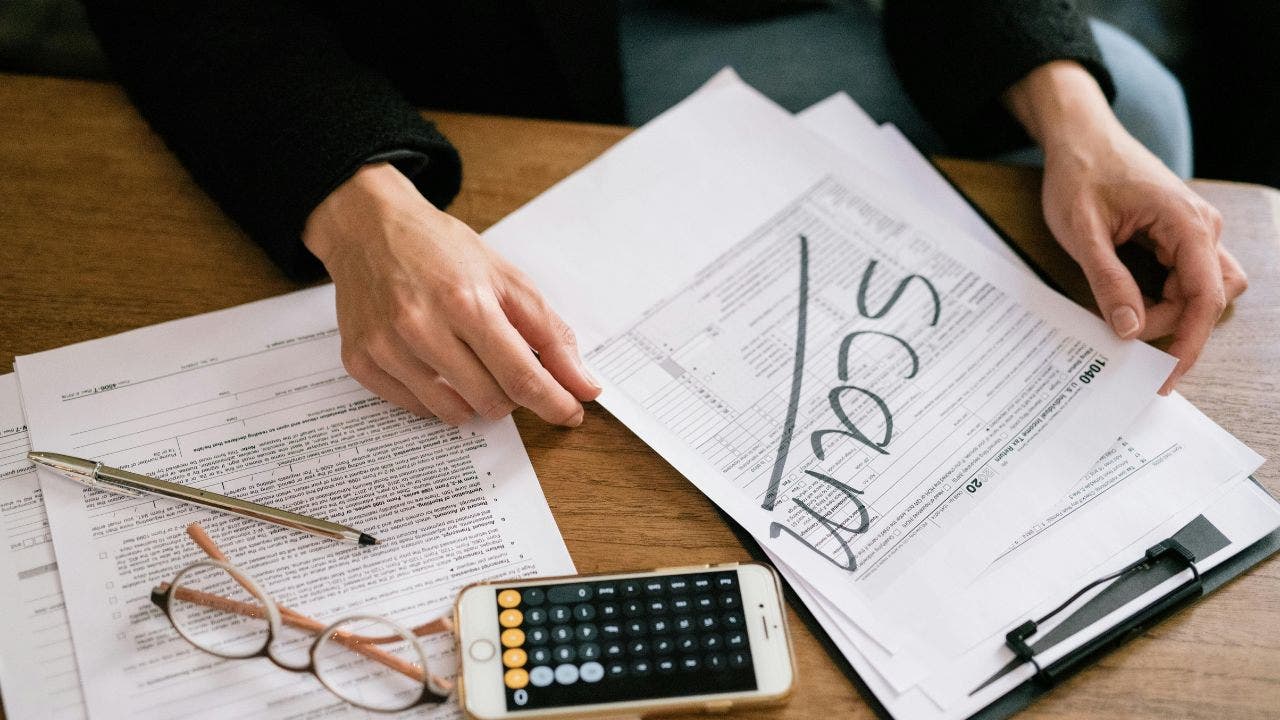

IRS impersonation scams surge targeting 2026 taxpayers during filing season

CITY, State (Fox News) — Tax season in 2026 brings confusion and opportunities for scammers as changes to tax filing programs and the discontinuation of the free government-run filing system leave taxpayers vulnerable.

## Why scammers thrive when tax rules feel unclear

Scammers take advantage of uncertainty by posing as official entities to create a sense of urgency and anxiety among taxpayers.

## The most common IRS impersonation scams right now

Scammers use various tactics such as fake refund messages and fake IRS login pages to trick taxpayers into sharing personal and financial information.

## Why phrases like new rules and urgent issues work

Language like new rules and urgent account issues trigger panic and prompt quick decisions from taxpayers.

## What happens after someone falls for a tax scam?

Victims of tax scams can face identity theft and financial loss, requiring months of effort to recover.

## How the IRS really communicates with taxpayers

The IRS does not reach out unexpectedly through email, text, or social media, and taxpayers should be cautious of urgent messages demanding immediate action.

## What to watch for next as scams evolve

Tax scams are becoming more sophisticated, with polished phishing emails, refund texts, and fake tax help ads.

## Ways to stay safe during tax season

Tips include slowing down before responding to messages, verifying changes through official channels, protecting accounts with strong credentials, and avoiding malicious links.

## Kurt’s key takeaways

Tax season pressure and filing confusion make people vulnerable to scams, emphasizing the importance of pausing, verifying, and trusting official sources.

Source: Fox News